“I didn’t happen to believe that. Or maybe I was just naive enough to overlook the depressing evidence. Or I just couldn’t let a bargain pass me by. For whatever combination of reasons—slices of all three, I suppose—I had always kept my eyes open for good real-estate buys. Because of the city’s shaky condition, the bargains weren’t that hard to find, especially on commercial buildings in the Upper-Manhattan neighborhoods that had always been my territory. How things have changed, right?” writes John Catsimatidis in his new book, How Far Do You Want to Go?: Lessons from a Common-Sense Billionaire. “When I found a solid piece of property at a reasonable price, my general philosophy was, Grab it! If I can’t find a find a tenant, I’ll put a supermarket there.

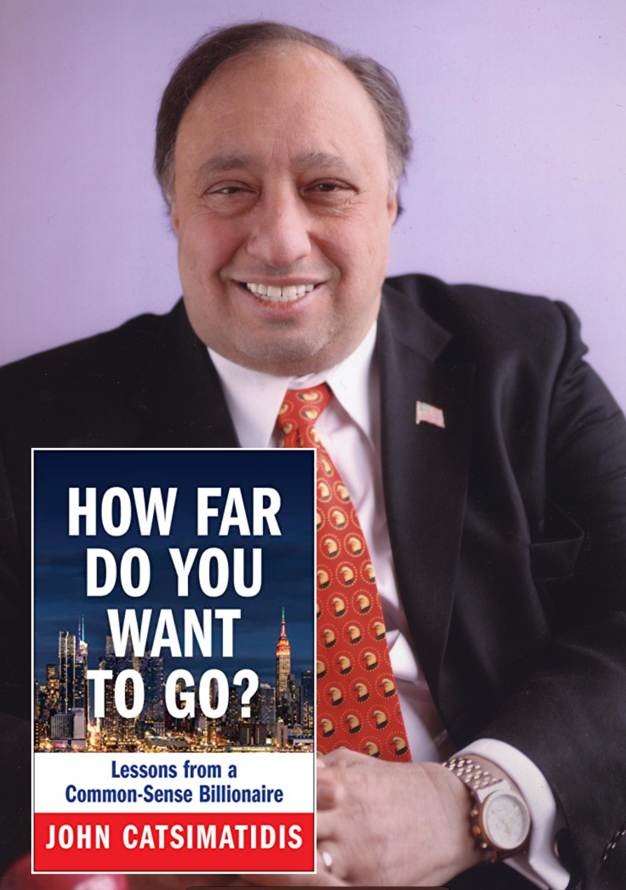

ABOUT THE AUTHOR/PROJECT: https://www.catsimatidis.com/about/

Either way, I was bound to come out ahead. I could own a building with a rent-paying tenant. Or if for some reason I couldn’t rent the space, I would have another location for a super- market without the headache of a greedy landlord raising the rent on me. And all the while, I figured it was only a matter of time before New York got back on its feet and those depressed property values started rising again. Real estate is an ideal backup plan for someone in a thin-margin business like supermarkets. I felt like I always needed a backup plan. Now, whether or not I made a lot of money selling groceries, I would also have real estate to rent or sell as I saw fit.”

He adds, “This also meant I was building a portfolio of assets that I could turn into collateral if I ever wanted to walk into a bank and seek a loan. Bankers like collateral, something of value to cover the money they are lending in case you fail to pay them back. They are much more comfortable lending money if they can tell their loan committees: “Don’t worry. He owns a lot of buildings.

We can always take one or two of those if he tries to skip out on the debt.”

That’s how bankers think. So even in my post-Capitol funk, an important realization was shoving its way to the front of my brain. If I could find a company worth buying but would need to borrow some money to finance the deal, I wouldn’t have much trouble getting a loan. The trick was keeping my eyes open for the right company. And wouldn’t you know it: the company found me—in bankruptcy court, no less.”

By making things straightforward and the tonality conveying a knowing ease, Catsimatidis is able to make the book live up to the succinctness of its titling. At the end of the day, what success really entails isn’t just an understanding of the data. It’s the ability to utilize taking calculated risks. Street smarts and book smarts share a slightly uneven relationship, with street coming out on top given the fact at its core achieving financial success requires a good sense of hustle, and a shrewd ability to wheel and deal consistently to one’s interests. “As the new owners of Capitol Airlines were trying to salvage what they could and we were working on getting our airplanes back, the federal bankruptcy trustee who was handling the matter was also over- seeing the liquidation of a regional chain of gas stations.

AMAZON: https://www.amazon.com/How-Far-You-Want-Common-Sense-ebook/dp/B0B2MGZ3MG

That would turn out be to an unexpected and wonderful coincidence,” Catsimatidis writes in this vein. “The gas station company had an impressive history and a serious-sounding name: United Refining Company. Until 1979, United Refining was publicly traded and listed on the New York Stock Exchange. But it ended up in the hands of some clever operators from Houston. They sucked so much cash out, they drove United Refining into bankruptcy. That’s when I stepped in.”

Jodi Marxbury